Fully trusted, fully secure

Authorised and regulated by the FCA, the oohMoolah process has been built to be secure from end to end.

The central hub for your credit score

Take control of your bank statement,

let us take care of the rest.

Authorised and regulated by the FCA, the oohMoolah process has been built to be secure from end to end.

Take control of your bank statement,

let us take care of the rest.

Your data, your consent, your permission.

oohMoolah is authorised and regulated by the Financial Conduct Authority (FCA).

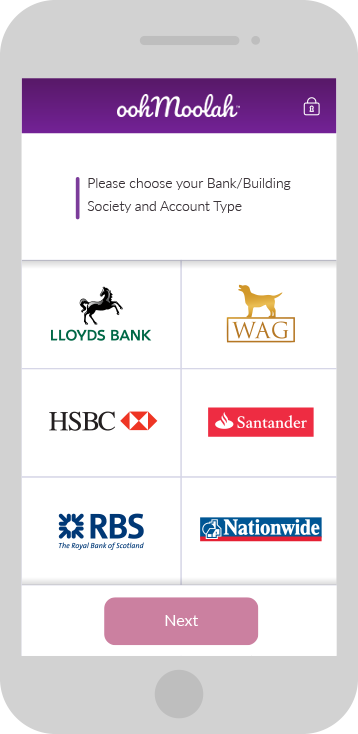

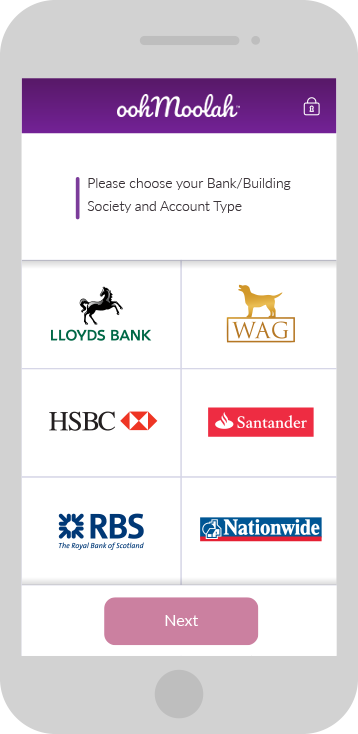

oohMoolah has access to all of the main uk banks and building societies.

By the jargon: oohMoolah is an FCA approved provider of bank account statements, primarily for credit-risk decisions made by credit providers.

Simply put: oohMoolah is a tool that puts you in charge of your credit information; who sees it and when.

Your data, your consent, your permission.

oohMoolah is authorised and regulated by the Financial Conduct Authority (FCA).

oohMoolah has access to all of the main uk banks and building societies.

Are you interested in who sees your financial credit information? And when? Then, yes. Yes it is.

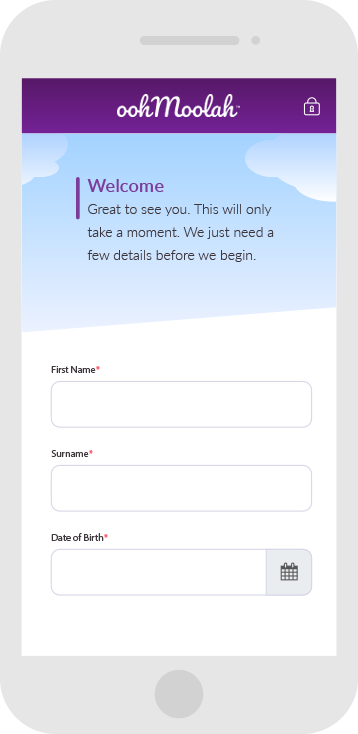

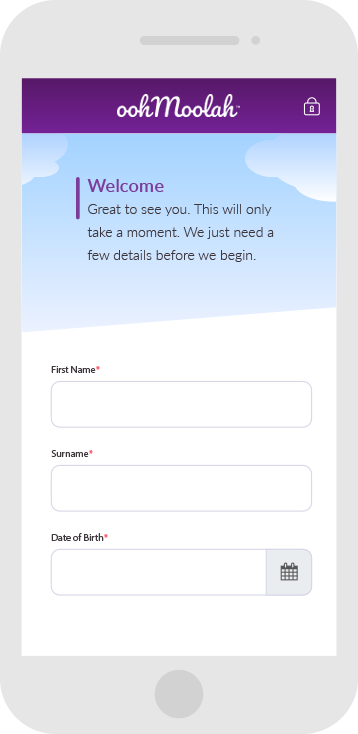

oohMoolah is nothing more than a brief, intuitive process to get you where you need to go.

Once you’ve been through our simple process, it’s smooth sailing!

oohMoolah is a service for Consumers to help provide read-only access to their bank statement data to their chosen credit provider.

You will be given the option of which bank or building society and which account to allow oohMoolah to see, the control is all with you. Once oohMoolah has been given permission by you then the bank account provider will supply your recent bank statement.

If you’re applying for a loan or another type of credit then your provider needs to make a fair assessment of your affordability, and how better to do this than with your up-to-date bank statement.

oohMoolah’s top priority is security, with the service designed to make your data secure, including full encryption of your data in transit and double encrypted when stored. oohMoolah is a service based on Open Banking which is highly secure.

More UK banks and building societies will be joining Open Banking during 2019.

oohMoolah is primarily used by businesses that need to make a financial assessment, such as lenders and other credit services. The businesses can include small personal and unsecured loans, to car finance and mortgages; from car insurance to utility companies and mobile phone providers.

During the oohMoolah process, we will ask for your explicit permission (also referred to as your consent) to communicate with your chosen bank account provider. This consent will explain what access oohMoolah is requesting and for what purpose, for example 90-days of statement data for the next 30-days access for a credit-risk assessment.

Once you have given oohMoolah your permission, you will then be passed to your bank account provider who will take you through your personal security steps, then show you the same consent again to verify. Only once this is all complete will oohMoolah be able to use your permission to access just the data you have selected.

You can view and control who has permission via your online banking. If you wish to cancel your permission then simply use your online banking to revoke, if you have any trouble then we would recommend talking to your bank account provider.

Please note, as your data may have already been passed to the business providing you a credit product or service, you may also wish to contact them too. Under the GDPR legislation, businesses must respond to any request to wipe or review your data.

Open Banking, is a new initiative and standardised legislation helping Consumers take control of their data and open up new innovative services and stimulate competition to the benefit of the public. The Open Banking structure allows FCA authorised providers, like oohMoolah, to smoothly interact with Banks and Building Societies.

The Payment Services Directive (PSD2) is a European Union directive which sets out the requirements for financial service providers to improve consumer protection, and make payments safer and more secure.

The Financial Conduct Authority (FCA) is an independent regulator with the primary aim of ensuring consumers using financial services are treated fairly.

oohMoolah are a FCA authorised “Account Information Service Provider” (AISP), as well as a Credit Reference Agency (CRA). As an AISP, oohMoolah are also members of Open Banking, and can ask for permission to connect to your bank account provider.

PISP stands for Payment Initiation Service Provider. oohMoolah is NOT a PISP. PISP’s can ask for permission to interact with your bank account provider and other service providers to initiate payments on your behalf.